What is the Margin of Safety in Investing? Why is it an important parameter Before Taking Any Investment Decision?

Let us assume you have to reach the office at 9.00 am for an important meeting and your normal commute time is 1 hour. What could potentially happen if you start at 8.00 am? There is a possibility that you will reach on time if things go well. But, what if there is traffic or your train is delayed? You may not reach on time. If you don’t reach on time, you may miss out on the important meeting. So, what can you do? It’s very simple. You start at 7.40-7.45 am so that even if there is traffic or there or there is some delay, you may still reach on time. This 15-20 minutes early start is known as the margin of safety. The concept of margin of safety applies to many different areas such as accounting and investing.

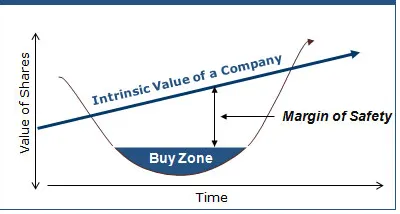

Now let us apply this concept to investing. You find out the intrinsic value of a stock. If the stock trades reasonably below its intrinsic value, it is said to provide a good margin of safety. If the stock provides a good margin of safety, you can go ahead and buy the stock. Let us consider this with an example. The stock trades at Rs 60-70. Suppose you find out that the intrinsic value of the stock is in the range of Rs 100. The difference of Rs 30 – 40 is known as the margin of safety. You go ahead and buy the stock.

Let’s presume you end up buying the stock at Rs 100, where the market price is equal to the intrinsic value. If things pan out well in the future, it will definitely prove to be a good investment. However, if there are unforeseen risks in the future, it may not turn out to be a good investment and if your assumptions of forwarding earnings were wrong then you may end up losing money in that investment. So Margin of Safety helps one to stay protected.

Remember what Warren Buffet Said,

Rule No1:- Never Lose Money

Rule No 2:- Never Forget Rule Number 2.

With Margin of Safety, one can be assured that he is following Buffett’s path of investing.

So, the next question that arises is how to calculate intrinsic value. Unfortunately, there are no clear answers to this question. The calculation of intrinsic value is very subjective. Some may use Discounted Cash Flow Method( DCF), SOme May use the Dividend Discount Model in Dividend Paying Stocks.

In real-life situations, it may not be possible to assess the fair value of an asset in accurate terms. But, we may be able to find a range of values between which the intrinsic value falls. While calculating the intrinsic value, it is important to look at what will happen in the future. While looking at the future, an estimate of three to five year forward earnings can be made.

Should you calculate the intrinsic value of every stock that is available in the market? It is not possible to do so for any investor.

I believe a person cannot be right about the industry’s business prospects or earnings forecast who has not a thorough understanding. More understanding will come through experience.

For Eg:-

- I have worked in Steel Trading Business for around 10 Years with my father, So I can understand price cycles and how it impacts earnings. I have worked as an intern in JSW Steel for 5-6 Months, I have had an affinity towards the steel industry since my childhood. This curiosity has made me understand various types of plants in an integrated steel plant. So Understanding Steel Manufacturing and Trading Business become my circle of competence.

- I have worked as a Sub- Broker for around 5 Years, So I understand well what it takes to run a profitable broking business. So Broking Companies becomes my Circle of competence

- I have worked as a Trainer and Business Development with National Mutual Fund Distributor NJ India, So I have a good understanding of how AMS”s Work, So this becomes my circle of competence.

- During my college times, I regularly used to visit sugar manufacturing plants. Things I realized that there is nothing in sugar industries that can take u in loos if you are an efficient producer. So SUgar Manufacturing Businesses became my Circle of Competence.

If you wish to read more about Circle of Competence, Clink the link below:- https://strategicalpha.in/2020/06/04/circle-of-competence-a-mental-model-to-avoid-disasters-in-investing/ This would help in understanding the concept of a circle of competence. If you understand the business in and out, you can estimate the margin of safety with a high degree of accuracy.

This is How Margin of Safety is Used in Entire Value Investing Strategy.

Join Me On My Telegram Channel Where I Share Much More Value Adding Knowledge Of Investing/ Trading: Click Here

Also, Don’t Forget To Follow Us On Our Social Media Accounts:

Facebook: https://www.facebook.com/strategicalpha/

Instagram: https://www.instagram.com/strategicalpha/

Twitter: https://twitter.com/suyog_dhavan

YouTube: https://bit.ly/2IIqztO

Very important note: The objective of this blog is to share knowledge and info about multi-bagger ideas/opportunities. Neither is this trading website nor an analyst website nor a Buy/Sell call website. For stock market success, always do your homework, own analysis, and make your own decisions.