The journey of investing and trading is like a rollercoaster ride. There are constant ups and downs, so you just can’t keep up with it if you are growing at a constant pace. There are new things to learn every day. In order to be successful, you must be active and able to generate investment ideas as per the latest market trends. If you wonder how to generate investment ideas, Suyog Dhavan has explained it very well in the attached video.

This blog breaks down the best ways to find investment ideas as per Suyog Dhavan, the founder of Strategic Alpha and an investor with over 15 years of experience. Let’s discuss the 10 simplest ways to generate investment ideas in the stock market. Before that, let’s understand why there is a need for new ideas at the first place:

Why is There a Need for New Ideas Constantly?

According to Suyog Dhavan, below are some key reasons to look for new ideas constantly in stock market investing:

- Increasing your circle of competence

- Know more in depth-same COC

- To sharpen your axe, 1% improvement on a daily basis (This is inspired by the 1% improvement rule for success from the book ‘Atomic Habits’)

- Find a replacement for existing not so not-so-great ideas that we already hold.

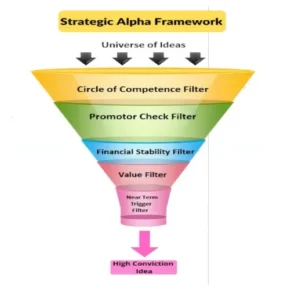

Strategic Alpha Framework for Generating a Universe of Creative Investment Ideas:

How to Find The Universe of Ideas? The 10 Simple & Effective Ways

Below are the ways to generate investment ideas that Suyog Dhavan followers and recommends every investor to follow:

1. Social media

Social Media has a lot of information available for free. But you should be wise enough to decide which information to pick and which not. Instead of generic social media platforms, you can login to platforms like Valuepickr, which is a forum of like-minded investors co-founded by Ayush Mittal. Anyone can post a thread on this platform, and people can continue the thread by posting their analysis or studies about a particular stock or industry. It becomes easier for people to gather information from multiple analysts and trading professionals.

Another platform is Multiple (www.multiple.com), which is very similar to Valuepickr. It is a forum where you can sign up and start. Suyod Dhavan also mentions some Telegram channels like Fundamentals Study, which is most probably a bot that collects information from multiple sources and gives it to you at one place.

2. Reports

Annual reports of companies can be much more useful than you think. Suyog mentioned in the above video that he reads about 100-150 reports annually. If you don’t know how to read annual reports, here’s how you can do it and which reports to choose:

- Credit rating reports (tell about the company’s credit profile and overall financial health)

- DRHPs (Draft Red Hearing Prospectus – where companies have to give all information about their business, industry competitors, and more).

- Equity/sector research reports (you can refer to Equirus & Alpha Investo, which is a blog that Suyog follows, where you can find articles related to industries and companies. It will help increase your understanding of a particular sector and improve your circle of competence.

- Investor presentations

3. Investing/trading events/networking

You can attend events like the annual Strategic Alpha Symposium, where like-minded investors come together, discuss, and grow. Apart from this, you can attend events like the traders carnival, the Indian Investing Conclave (IIC), and network with other investors. There are more than 6000 stocks listed on the Indian stock exchanges, so working single-handedly to generate ideas might be difficult. Attending such online and offline events can be very helpful. For example, IIC is like Netflix for investors – indian investing conclave – you can also select free sessions and watch videos by experts.

4. BSE corporation announcements

To stay updated with all the BSE corporation announcements, you can refer to the BSE website or screener tool (screener.in/announcements ). This tool is accessible to paid members and might or might not work for unpaid ones. You can make categories, and upon selecting them, you will get to see all announcements made by companies under those categories.

5. Earning breakouts

This is another thing that you can do on SCreener tool itself. Just reate a screener query or category and put an alert. You will get the required information on your screen and alerts for your specific query.

6. Merger/demerger announcements

For merger and demerger announcements, Investkaroindia is a great platform. It is a dashboard created within tableau. It keeps a track of all upcoming special occasions. For example, you can see expected demerger dates if demergers or reverse mergers, etc. Dermergers provide value unlocking opportunities so keeping a track of them can be helpful. Another way to do this is to create a category ‘demerger’ under screener.in and you will get information about all of them.

7. Fundamental screeners

You can create custom queries and get all the information about companies that fall under the criteria set by you. The above query was created to find nanocap megabaggers on the Screener tool. Another criterion is the golden crossover that you can consider and find on Screener. There are a lot of screens on Screener that will give you great ideas. Another tool that you can use for this purpose is tijorifinance.com.

8. Technical screeners

For this, StrategicAlpha Alerts is one of the best tools. It is a tool created by Strategic Alpha, which will be made public very soon. It is a tool that Suyog uses to generate ideas. It gives alerts when a stock price breaks out and is about to become a multibagger. Daily, weekly, and monthly breakouts and moving average crossover alerts – to increase efficiency in investing. Not missing any multibaggers due to automated alerts.

9. Management Interviews & Conference Calls

You can watch management interviews on YouTube to find out what’s going on in a particular company or industry. Apart from this, conference calls of companies can be a great source of information. On screener.in, you can find transcripts of companies. Another source for this is Trendylyne YouTube channels, where you can find lots of conference call recordings. Moreover, many company websites also provide conference call summaries or transcripts. Concol summaries are also available on the Strategic Alpha website

10. BONUS Source

According to Suyog Dhavan, being a shameless copycat can also help you in stock market success. Ppeople who copy ideas of smart investors smartly are likely to win. You can copy the ideas, but do not copy the conviction. Some investors that Suyog resonates with are vijay kedia, ashish kocholia, dolly khanna, ashish dhawan, porinju, monish pabrai). He doesn’t follow them now, but he used to do that earlier. It gives you a sense of confidence. Conviction has to be developed and should be from your circle of competence. The stock should resonate with your personality, pocket, etc. if you have the strategy in place and follow a single strategy and single mentor, it will help you resonate.

Course of Action:

Register for the upcoming workshop of Strategic Alpha – webinar.strategicalpha.in, where you get to learn techno Value investing, get new investment ideas, and latest market information. Also, subscribe to the strategic alpha blog, as whatever we find out is put on our blogs. Also, make sure to follow Strategic Alpha on YouTube to get the latest updates and genuine stock market-related information.

Also read this blog:- Stock Market vs Fixed Deposits: Pros and Cons